In an ideal world, healthcare providers and patients would find one another only based on satisfaction ratings, referrals and recommendations, or simply because of a convenient practice location serving the needs of the surrounding community.

The reality? Patients typically first evaluate potential providers by posing just one question: Do they take my insurance?

In several recent consumer research polls, between 72 and 83 percent of respondents reported that whether a physician is covered by their insurance plan is the key determining factor in whether or not they approach them for their health care needs. While other variables like wait times and rapport with patients were also important factors, most providers won’t even get an opportunity to establish that relationship if the answer to that crucial first question is negative.

“If you’re a brand-new physician, you need volume to cover overhead,” says Greg Mertz, a physician management specialist and managing director of Physician Strategies Group in Virginia Beach, Virginia. “Every practice needs to be affiliated with the largest payers.”

That information isn’t always easy to come by. While physicians can ask peers in their markets for advice, they still run the risk of missing a key commercial carrier that could impede the kind of volume new practices need to establish a patient base and cover expenses. When you’re not inclusive of those individuals, Mertz says, the consequences are predictable. “The competition gets those patients.”

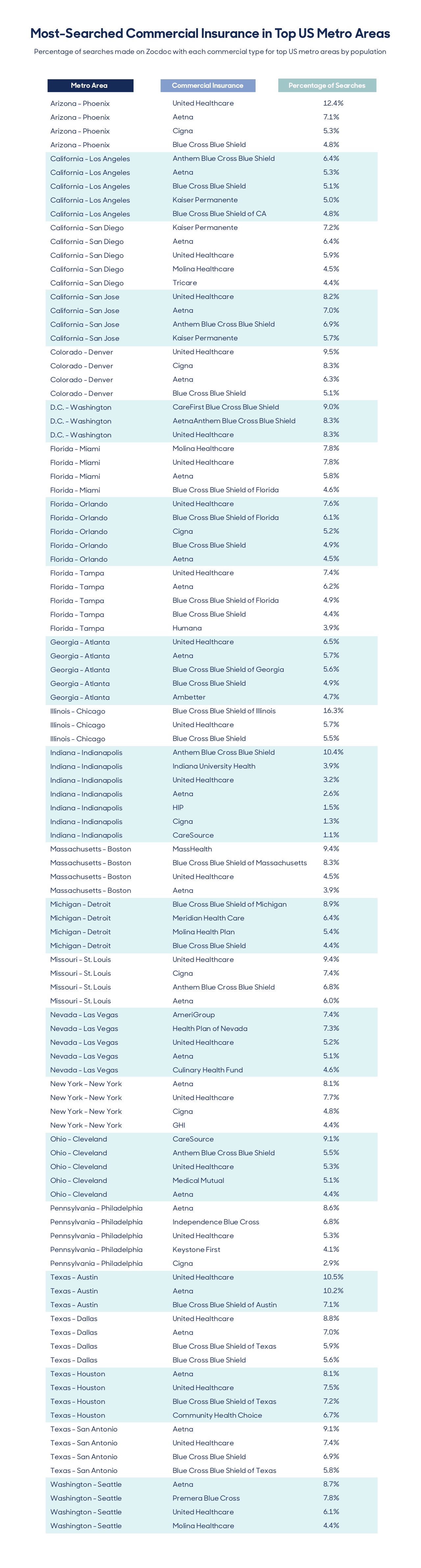

The Most-Searched Commercial Insurance Carriers in Your Area

To avoid that outcome, we looked at the top metro areas in the country based on population size and analyzed the insurance carriers that make up at least 25% of searches when Zocdoc users are looking for providers. By reviewing the charts below, you can be certain you’re structuring your practice to include the most-searched carriers in your area. Take a look, and then keep scrolling—we’ve got more advice below.

As you can see, acceptance of the widely-used “blues” carriers along with other major commercial carriers like Aetna and Cigna make it possible to keep your pool of potential patients as large as possible.

Letting Patients Know Your Networks

The asterisk? Being in-network and having a patient know you’re in-network are, unfortunately, two different things. Almost as important as participating is letting people know you’re on a carrier’s roster.

According to Mertz, disseminating that information is easy, provided your practice is savvy with social media (and it should be), or online marketplaces, like Zocdoc. “Almost every practice has some kind of web presence these days,” he says. “Putting it out there that you take United, or Aetna, or whatever it might be is key.”

Previously, patients might have scrolled through a monotonous alphabetical listing of providers presented by their insurance company. If you weren’t a Doctor Aardvark, you ran the risk of getting lost in the wall of text. Now, Mertz says, new technologies are making a significant shift to allowing searches based on insurance carrier, while also taking into account patient satisfaction scores and star ratings. For newer providers without much of a review history, that means increasing their web presence and relying more on marketing until their reputation begins to precede them.

Additional Factors to Consider

Good doctors will eventually begin to worry less about working with the most pervasive insurance carriers and more about which ones have the most appealing options, particularly once their patient roster begins to exceed their capacity for care. When that happens, Mertz recommends sitting down and figuring out which companies are offering comparatively meager reimbursement and which demand reams of labor-intensive paperwork.

“When there are barriers and hassles in getting your job done, you can make a decision to drop a carrier,” he says. Certain specialists will also have a degree of bargaining power. “If a 30-provider orthopedic group goes to a carrier and says, ‘How badly do you want to keep people out of the emergency room?’ then they’ll probably want to work with that provider, who is cheaper to pay than a hospital.”

Whether you’re a new or established practice, it’s inevitable that calls will come in from patients asking your practice to accept insurance you simply don’t have the bandwidth, desire, or opportunity to engage with. (Don’t forget that some carriers may have put caps on participating providers.) That doesn’t have to mean losing a patient, however. When you don’t currently accept a payer, your office can offer a discount for a cash payment, which is likely to be more palatable to patients already facing high-deductible plans.

Finally, Mertz advises that new practices shouldn’t get too caught up in reimbursement differentials. While one payer might pay significantly less than another, if the former is widely accepted in your area, go with the flow. “When you’re a new provider, any money is better than no money.”

When can you afford to be more selective? “When you’ve got a waiting list,” he says.![]()